Companies Featured

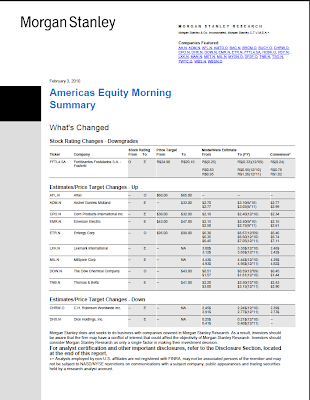

AA.N, ADM.N, AFL.N, AMTD.O, BAC.N, BRCM.O, BUCY.O, CHRW.O, CPO.N, DHX.N, DOW.N, EMR.N, ETR.N, FFTL4.SA, HCBK.O, HSY.N, LXK.N, MAN.N, MET.N, MIL.N, MYGN.O, SFSF.O, TNB.N, TSO.N, TWTC.O, WBS.N, WBSN.O

AA.N, Alcoa Inc. ($13.67) /Sell-Off an Opportunity for Long-Term Investors

Mark.Liinamaa@morganstanley.com, Paretosh.Misra

We are more optimistic than the market as previous concerns resurface post 4Q09 earnings

miss. Investors question whether cost-cutting initiatives will accrue to shareholders, and Alcoa’s

ability to deliver leverage to the aluminum price. We think 4Q was better than perceived. Further, we think that cost cutting has been effective and that leverage to aluminum will become more visible as operating rates at downstream assets recover from recession levels. The shares are down ~22% since reporting 4Q09 earnings, and the market may take a wait-and-see approach. Before investors broadly consider the longer-term investment case, the company may be required to deliver a strong 1Q10. Based on recent trends in the aluminum price and cost drivers, we estimate EPS of $0.15 is possible, vs. our current estimate of $0.12.

BAC.N, Bank of America ($15.60) /Mgmt Meeting Highlights Opportunities for

Credit & Efficiency Improvements

Betsy.Graseck@morganstanley.com, Cheryl.Pate, Matthew.Kelley Our recent meeting with BAC management highlighted opportunities for credit and efficiency improvements in the consumer business. Management discussed the state of the consumer, card, deposits, and payments businesses, as well as the regulatory environment and the internal pulse of the organization now that it has exited TARP and appointed a new CEO. Management was measured, but optimistic on the future given credit and efficiency improvements.Longer-term deposit growth drivers include mass affluent and higher-end segments (in part aided by MER acquisition). Efficiencies come from reinvesting to push down error rates and enabling customers to choose their basic products and delivery channels and then pay for value-added services.

[POTENIAL CONFLICT OF INTEREST]

Morgan Stanley is currently acting as financial advisor to a number of investors, led by First Republic's existing management, and including investment funds managed by Colony Capital, LLC and General Atlantic LLC with respect to their acquisition of First Republic Bank from Bank of America Corporation. The proposed transaction is subject to customary regulatory approvals, as well as certain customary closing conditions. Morgan Stanley expects to receive fees for its financial services that are subject to the consummation of the proposed transaction. Please refer to the notes at the

end of the report.

READ FULL REPORT HERE

No comments:

Post a Comment