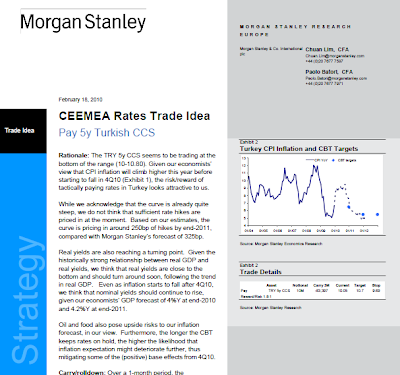

Rationale: The TRY 5y CCS seems to be trading at the bottom of the range (10-10.80). Given our economists’

view that CPI inflation will climb higher this year before starting to fall in 4Q10 (Exhibit 1), the risk/reward of

tactically paying rates in Turkey looks attractive to us.

While we acknowledge that the curve is already quite steep, we do not think that sufficient rate hikes are priced in at the moment. Based on our estimates, the curve is pricing in around 250bp of hikes by end-2011,

compared with Morgan Stanley’s forecast of 325bp.

Real yields are also reaching a turning point. Given the historically strong relationship between real GDP and real yields, we think that real yields are close to the

bottom and should turn around soon, following the trend in real GDP. Even as inflation starts to fall after 4Q10, we think that nominal yields should continue to rise, given our economists’ GDP forecast of 4%Y at end-2010 and 4.2%Y at end-2011.

Oil and food also pose upside risks to our inflation

forecast, in our view. Furthermore, the longer the CBT

keeps rates on hold, the higher the likelihood that

inflation expectation might deteriorate further, thus

mitigating some of the (positive) base effects from 4Q10.

Carry/rolldown: Over a 1-month period, the

carry/rolldown on a pay 5y CCS position is around -9bp.

This compares more favourably with -20bp in 2y and

-22bp in 1y.

Alternatives: We still like paying breakeven inflation by

holding 2y linkers versus paying 2y CCS.

Key risks: Persistent lira strength, a significant

improvement in inflation profile (e.g., lower oil or food

prices), a potential IMF package and a lower domestic

debt rollover ratio in March and April could put

downward pressure on rates, in our view.

Link here

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=9640ac1c-0f1a-4f6d-9178-ad7a1bb6581a)

No comments:

Post a Comment