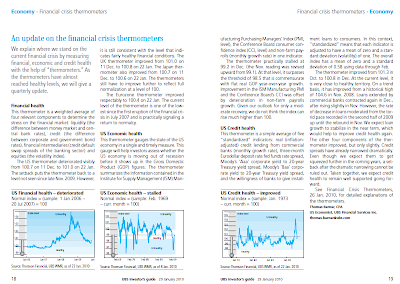

We explain where we stand on thecurrent financial crisis by measuringfinancial, economic and credit healthwith the help of “thermometers.” Asthe thermometers have almostreached healthy levels, we will give aquarterly update.

Financial health

This thermometer is a weighted average of four relevant components to determine the

stress on the financial market: liquidity (the difference between money market and central

bank rates), credit (the difference between corporate and government bond rates), financial intermediaries (credit default swap spreads of the banking sector) and equities (the volatility index).

The US thermometer deteriorated visibly from 100.7 on 11 Dec. to 101.0 on 22 Jan.

The setback puts the thermometer back to a level not seen since late Nov. 2009. However,

it is still consistent with the level that indicates fairly healthy financial conditions. The

UK thermometer improved from 101.0 on 11 Dec. to 100.8 on 22 Jan. The Japan thermometer

also improved from 100.7 on 11 Dec. to 100.6 on 22 Jan. The thermometers still have to improve further to reflect full normalization at a level of 100.

The Eurozone thermometer improved respectably to 100.4 on 22 Jan. The current level of the thermometer is one of the lowest since the first eruption of the financial crisis in July 2007 and is practically signaling a return to normalcy.

US Economic health

This thermometer gauges the state of the US economy in a single and timely measure. This

gauge will help investors assess whether the US economy is moving out of recession

before it shows up in the Gross Domestic Product (GDP) figures. The thermometer

summarizes the information contained in the Institute for Supply Management (ISM) Manufacturing Purchasing Managers’ Index (PMI, level), the Conference Board consumer confidence index (CCI, level) and non-farm payrolls (monthly growth rate) in one indicator.

The thermometer practically stalled at 99.2 in Dec. (the Nov. reading was revised upward from 99.1). At that level, it surpasses the threshold of 98.5 that is commensurate with flat real GDP year-over-year growth. Improvement in the ISM Manufacturing PMI and the Conference Board’s CCI was offset by deterioration in non-farm payrolls growth. Given our outlook for only a moderate recovery, we do not think the index can rise much higher than 100.

US Credit health

This thermometer is a simple average of five “standardized” indicators: real (inflationadjusted) credit lending from commercial banks (monthly growth rate), three-month Eurodollar deposit rate fed funds rate spread, Moody’s ‘Aaa’ corporate yield to 20-year Treasuy yield spread, Moody’s ‘Baa’ corporate yield to 20-year Treasury yield spread, and the willingness of banks to give installment loans to consumers. In this context, “standardized” means that each indicator is adjusted to have a mean of zero and a standard deviation (volatility) of one. The overall index has a mean of zero and a standard deviation of 0.58 using data through Feb.

The thermometer improved from 101.3 in Oct. to 100.8 in Dec. At the current level, it

is very close to healthy territory. On a trend basis, it has improved from a historical high

of 104.6 in Nov. 2008. Loans extended by commercial banks contracted again in Dec.,

after rising slightly in Nov. However, the rate of decrease in loans moderated from the torrid

pace recorded in the second half of 2009 up until the rebound in Nov. We expect loan

growth to stabilize in the near term, which would help to improve credit health again.

The other four components of the thermometer improved, but only slightly. Credit

spreads have already narrowed dramatically.

Even though we expect them to get squeezed further in the coming years, a setback

after the dramatic narrowing cannot be ruled out. Taken together, we expect credit

health to remain well supported going forward

-ubs investors guide

No comments:

Post a Comment