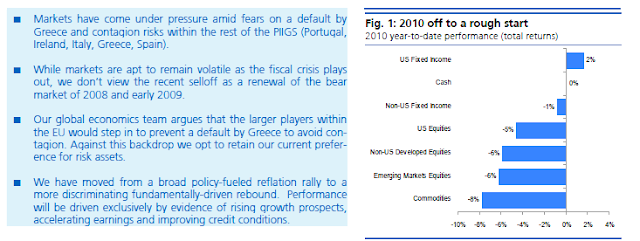

Markets have come under renewed pressure during the past severalweeks amid concerns over the prospects for policy tightening, newfinancial market regulation and a fiscal crisis within the Eurozone. While each of these events has impacted markets to varying degrees, itis the prospect of a sovereign default by Greece and contagion riskswithin the rest of the PIIGS (Portugal, Ireland, Italy, Greece, Spain) thathas been the primary catalyst behind the recent acute selloff. There isunderstandable fear that the current fiscal crisis in Greece could ripplemore broadly through the market for risk assets as investors flee forthe relative safety of dollar-denominated treasury debt. An unwinding of so called dollar “carry trades” has already pushed the greenback upto its highest level in more than eight months. Meanwhile, the S&P500 has now fallen 8% over just the past three weeks. With memoriesof the 2008 credit-inspired market meltdown still fresh, the prospectsfor a renewed phase of portfolio “de-risking” cannot be dismissed.

It remains our view however, that the fiscal problems within Greeceand other EU nations do not represent a new more virulent strain ofthe global credit crisis that nearly drove financial markets to ruin.Greece, Portugal and Spain will continue to face serious budget chal-lenges in the months and even years ahead. However, the prospectsfor a near-term default by one of the PIIGS remain low. Although theEU has no clear bailout mechanism for dealing with such events, it isunlikely that the Eurozone will allow an outright debt default by one ofits member nations. Our own global economics team argues that thelarger players within the EU (i.e., Germany and perhaps also France) would step in to prevent a default by Greece out of fear that such anevent could trigger contagion that would threaten the euro and desta-bilize the union. Against this backdrop we opt to retain our currentpreference for risk assets.

While markets are apt to remain volatile as the fiscal crisis plays outand credit default swap spreads trade at elevated levels, we don’t viewthe recent selloff in equity and credit markets as the renewal of thebear market that triggered the rout in risk assets during 2008 and early2009.

FULL REPORT HERE

Gauging the fallout

The credit crisis and related recession that ripped through much of thedeveloped world over the past several years left goverment finances a mess. Keep in mind that many nations were already grappling with large

structural budget deficits due to aging populations even before the global credit crisis hit. The sharp drop in revenues associated withthe recession and extraordinary measures undertaken by policymakersin the aftermath of the crisis have served to greatly exacerbate thefiscal crisis. These issues have surfaced most acutely in Greece, which ishobbled by a budget deficit that exceeds 12% and accumulated debtthat totals more than 110% of GDP. There is justifiable concern thatthe Greek government will be unable to effectively deal with magni-tude of the crisis on their own. While the budget proposal from Greek Finance Minister Papaconstantinou would dramatically reduce thebudget deficit, we think it lacks credibility. According to our econo-mists, the proposal assumes the economy will expand at near trendrates in 2011 and 2012 despite a draconian tightening of fiscal policy.This seems unlikely. So while some level of fiscal consolidation willlikely occur, the proposal currently being floated by the Greek govern-ment appears unrealistically optimistic.

structural budget deficits due to aging populations even before the global credit crisis hit. The sharp drop in revenues associated withthe recession and extraordinary measures undertaken by policymakersin the aftermath of the crisis have served to greatly exacerbate thefiscal crisis. These issues have surfaced most acutely in Greece, which ishobbled by a budget deficit that exceeds 12% and accumulated debtthat totals more than 110% of GDP. There is justifiable concern thatthe Greek government will be unable to effectively deal with magni-tude of the crisis on their own. While the budget proposal from Greek Finance Minister Papaconstantinou would dramatically reduce thebudget deficit, we think it lacks credibility. According to our econo-mists, the proposal assumes the economy will expand at near trendrates in 2011 and 2012 despite a draconian tightening of fiscal policy.This seems unlikely. So while some level of fiscal consolidation willlikely occur, the proposal currently being floated by the Greek govern-ment appears unrealistically optimistic.However, it remains our view that Greece will not default on their debt – at least not in the very near term. Following a recent meeting of theEuropean Central Bank Governing Council, ECB president Trichet vreit-erated the need for fiscal consolidation in his prepared remarks. But Trichet also stressed that the solidity of the euro was not at risk, andonce again expressed confidence that member nations would be ableto deal with these fresh set of challenges. No one at the ECB has en-dorsed a direct bailout of Greece by EU members since such an effortwould be politically unpopular and would also signal that difficultchoices can be avoided by nations that have exercised little fiscal re-straint. Instead, it’s more likely that some fiscal tightening along thelines of the budget plan by the Greek Finance Minister is likely. How-ever, if this proves insufficient – or if social unrest flares in Greece asmany fear – then a broader IMF-directed assistance program with the financial backing of EU heavy-weights could be undertaken. This wouldallow the EU to provide support to Greece, but under the guise of anIMF sponsored program.

Concerns over a “contagion” across the EU region are also a bit over-done, in our view. Equity markets in Spain and Portugal sold off intandem over fears that the fiscal crisis in Greece would spill over intothe rest of the PIIGS. These concerns were clearly reflected in the sharpjump in credit default swaps for both countries, as well as the difficultyPortugal had in attracting interest at a recent bill auction following the rejection of the government’s austerity proposal. While the fiscal prob-lems within the EU are not limited to Greece, neither Spain nor Portu-gal is in the same dire circumstances. Policy makers in Madrid and Lis-bon face difficult choices themselves in the months ahead, but the conditions are nowhere near as acute as those facing leaders in Ath-ens.

It’s about “P” versus “E”, not P/E

We have repeatedly emphasized over the past two months that mar-kets were entering a transition phase. We have moved from a broadpolicy-fueled reflation rally to a more discriminating fundamentally-

UBS FS Market Update 3

driven rebound. This means that the outsized gains that were realized across risk assets as policy makers engaged in extraordinary policy moves have run their course. Going forward, performance will bedriven exclusively by evidence of rising growth prospects, acceleratingearnings and improving credit conditions. We believe these fundamen-tals will continue to show improvement as the economic data andearnings reports demonstrate that the expansion is deepening.

• Economic activity accelerated in 4Q09. Real US GDP growth of 5.7% was driven by less inventory depletion signaling stabilizing business confidence and an acceleration in final demand growth. The sharp rise in the headline ISM Manufacturing Index and itsNew Orders sub-component provide strong confirmation of anindustrial cyclical recovery.

• Fourth quarter earnings results have exceeded even our initial op-timistic, above-consensus forecast heading into the quarter. The“bottom-up” 4Q09 S&P 500 EPS figure has risen 9% duringearnings season from $15.81 to $17.21. Earnings quality has im-proved with an increasing number of companies not only exceed-ing consensus earnings estimates, but also beating revenue tar-gets. Forward-looking guidance has also been consistent with amoderate growth recovery

•Credit markets have continued to thaw. The Federal Reserve’sSenior Loan Officer’s survey for January 2010 showed the firstoutright easing of lending standards for commercial and indus-trial loans (C&I) and consumer installment loans since the middleof 2007 and a lower percentage of banks are tightening lendingstandards for both residential and commercial mortgages.

But we will certainly face some headwinds along the way. Currently,market participants are concerned about several macro and exogenousthreats ranging from policy tightening, to populist regulatory threats, to the fiscal challenges within the EU.

So in the near term the issue is not really about P/E. Markets are trad-ing at unchallenging multiples and rates are likely to remain low, sug-gesting that the relative valuation in risk assets is even more appealing.Instead, markets in the near term will be driven more by concerns that the “Ps” - prospects for tighter monetary policy; populist attacksagainst banks; threats of further deterioration within the PIIGS – could undermine the recovery and destabilize markets. It remains our view however that the “Es” – improving economic data and acceleratingcorporate earnings – will ultimately carry the day. So while markets willbe bumpy during this transition phase, we don’t view the recent cor-rection as the beginning of the next major downphase in the market. Instead, we look for markets to stabilize as the fundamentals continue to improve and concerns over monetary and fiscal policy issues gradu-ally abate. Click above

© UBS 2010.

Click here for full report

No comments:

Post a Comment