International Headlines

• China’s trade deficit comes in larger than forecast - Trade balance turned red in March, posting the first deficit since May 2004 at US$ 7.24bn (JPMorgan: -$2.3 bn; consensus: -$0.39 bn). We think the deficit will only be temporary. Seasonally adjusted, trade deficit came in more modest at $0.6bn. March exports rose 24.3% over-year-ago (JPMorgan: 28.2%; consensus: 26.9%), translating into a significant fall of 7.2%m/m, sa. This comes on the back of the strong 5.9%m/m, sa monthly average pace of expansion since December09, with the sequential trend growth moderating to a still decent level of 39.2%3m/3m, saar by March. We believe the decline last month represents some payback to earlier gains, rather than reverses the solid recovery trend in overall exports. Meanwhile, imports also rose notably at 64.7%oya in March (JPMorgan: 64.1%; consensus: 55.7%), translating into a 6.0%m/m, sa gain, though the sequential trend similarly moderated to 66.5%3m/3m, saar through March.

· China and the yuan – China reported a trade deficit over the weekend (as was expected), which officials from the country pointed to as evidence to refute claims that the yuan level was distorting economic relationships. The official Xinhua News Agency cited Yao Jian, a commerce ministry spokesman, as saying the March trade deficit “proves” that the level of the renminbi was not the “decisive” factor that caused trade imbalances. FT

· China & trade – despite a rare deficit, most economists think the trade balance will return back to surplus – Zheng Yuesheng, the customs statistics chief, said China was likely to remain a surplus country over the long run. March's deficit was a blip, he told state television. Reuters

· China’s “Davos” conf this weekend helps further thaw economic relations w/the US - Senior officials from both countries held meetings at Bo’ao Forum for Asia on the southern Chinese island of Hainan. Billed as China’s “Davos”, the annual forum came on the heels of Thursday’s trip to Beijing by Tim Geither. FT

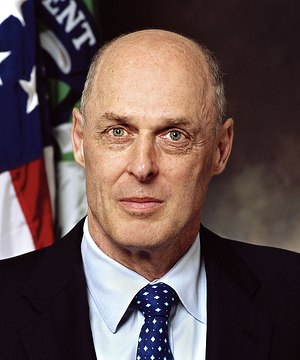

· China – Paulson says it’s in China’s interest to have a more flexible currency - Former U.S. Treasury secretary Henry Paulson said it was in China's interests to have a more flexible exchange rate to dampen inflation and help shift growth toward domestic demand. "You have to recognize that in the United States it is a symbol for China's commitment to continued reform. My message to my Chinese friends is this is something that needs to be taken seriously and managed so there is continuing progress," he said at the Boao Forum for Asia on the southern island of Hainan. Reuters

· China – Paulson says it’s in China’s interest to have a more flexible currency - Former U.S. Treasury secretary Henry Paulson said it was in China's interests to have a more flexible exchange rate to dampen inflation and help shift growth toward domestic demand. "You have to recognize that in the United States it is a symbol for China's commitment to continued reform. My message to my Chinese friends is this is something that needs to be taken seriously and managed so there is continuing progress," he said at the Boao Forum for Asia on the southern island of Hainan. Reuters · China gets tough on debt - China has set a strict timetable fo

r its banks to review local governments' off-the-books borrowing (WSJ) Banks are now required to reassess all the loans they made to local government companies on a "project-by-project" basis, Liu Mingkang, chairman of the China Banking Regulatory Commission, said Sunday at the Boao Forum for Asia. "By the end of this coming June, all of the banks are required to submit comprehensive reassessment reports to us about that area's exposure," WSJ

r its banks to review local governments' off-the-books borrowing (WSJ) Banks are now required to reassess all the loans they made to local government companies on a "project-by-project" basis, Liu Mingkang, chairman of the China Banking Regulatory Commission, said Sunday at the Boao Forum for Asia. "By the end of this coming June, all of the banks are required to submit comprehensive reassessment reports to us about that area's exposure," WSJ

· China vice president Xi Jinping says the country must emphasize domestic consumption; “we must develop the economy mainly by relying on the domestic market and attach great importance to domestic demand, esp. consumption demand, in driving economic development” Bloomberg

· China faces tariffs – the US Commerce Dept has approved duties of ~30-99% on imports of Chinese steel pipes used in oil and gas wells; the duties followed a complaint by X – Bloomberg

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=0db4732e-4a55-43c3-859d-108f8f0652e9)

No comments:

Post a Comment