Todays TOP Stories by theback9 04/12/10

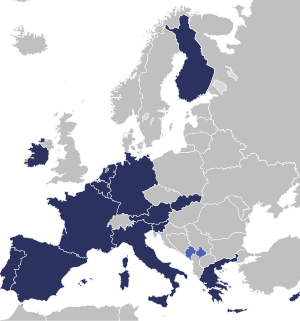

• Greece - the big story over the weekend being the announcement by Eurozone governments of a loan package for Greece worth at least EU30B (US$41B). From JPM’s D. Mackie – “In our view, the support mechanism should work in the sense of limiting both near term liquidity stress on Greece and contagion in the rest of the region. But, the medium term issue of debt sustainability remains.” JPMorgan’s J. Normand comments re the loan that “These terms are good but not great.”

• Greece - Luxembourg PM Junker told reporters on Sunday that “this is a step of clarification that markets are waiting for – it shows there is money behind this”. A “loaded gun” to ward of speculators is now “on the table” according to Greece’s PM. The agreement came about after Germany dropped its opposition to subsidies for Greece lending. Greece has not asked for aid from its euro zone peers, a German government spokesman said on Monday, adding that a summit of European leaders would be needed to activate a financial rescue mechanism agreed for Athens; "Just because I have a fire extinguisher on the wall doesn't mean I'm going to use it," (an EU spokesman denied the German comment about a summit being required….. "No. We do not have to organise a big summit here in Brussels. As you saw yesterday, the euro group can activate itself in a very quick, effective ... way.". Bloomberg/Reuters

• Spain - Spain’s PM told the FT this weekend that the country will implement its economic austerity plan to cut its budget deficit “whatever the cost”, and will introduce even harsher measures if necessary.

• Poland - Polish president Lech Kaczynski and other high ranking officials from the country were killed in a plane crash (the president of the National Bank of Poland, the army chief of staff and the Deputy Foreign were also on board the plane – WSJ).

• China - A few China datapoints out overnight inc. 1) March Trade balance came in as a deficit as was expected but the magnitude was greater than the St. was looking for (-$7.24B vs. St. -$0.39B), 2) Chinese banks extended a less-than- estimated 510.7 billion yuan ($74.8 billion) of new loans in March, and 3) China’s FX reserves rose at a slower pace in Q1 vs. Q4 (+$47.9B vs. +$127B). Re the Yuan and a potential devaluation, Chinese officials pointed to the March deficit as evidence to refute claims that the yuan level was distorting economic relationships and PBOC governor Z. Xiaochun said he doesn’t know where the NYT received its story about an imminent revaluation last week. Property Developer shares were weak in Asia after a top China bank regulator said the country's banks must do more to rein in risky lending to land developers (Reuters) with some banks in Beijing “voluntarily and prudently” raising down-payment requirements for second mortgages to 60% of a property’s value.

• Thailand equities slump ~5% on back of this weekend’s violence - Violent clashes broke out over the weekend between antigovernment protesters and the armed forces (WSJ)

• Cost of the financial bailout shrinking quickly; as aid recipients quickly get back on their feat, companies that some thought of as zombies just a few months ago are refunding Washington, many times w/a profit for taxpayers. The current bailout cost forecast is $89B, much lower than prior forecasts of $250B+; the $89B is 42% less than the S&L crisis of the early ‘90s (WSJ)

• AIG – Washington officials are increasingly optimistic that even AIG could be on its own within a year; officials at the Fed and Treasury are working on solutions to fully remove themselves from AIG’s capital structure (WSJ)

• Ad spending – consumer staples companies (inc. PG, CL, KBB, CLX) are raising their ad budgets (WSJ)

• Earnings season – WSJ warns that stocks could trade down as earnings hit, similar to their reaction to Q4 #s back in Jan, as expectations are frothy; Analysts' earnings forecasts also suggest optimism is running even higher now than three months ago (WSJ)

• Banks become creative on capital – some banks have started to look for ways to circumvent the most punitive capital rules being drawn up by regulators. The initiatives focus in particular on monetizing deferred tax assets (FT)

• UBS pre-announced this morning a Q1 pre-tax profit of at least Sfr2.5bn, vs. JPMe Sfr2.2bn and consensus of Sfr2.0bn. This announcement comes before its AGM on 14th April, 2010, and Q1 010 results will be released on 4 May 2010 (the stock is trading higher in Europe although the announcement today not a huge surprise – keep in mind Bloomberg reported a couple weeks back that the company was having a very strong FI Q).

• Tech update - earnings season kicks off technically overnight tonight w/INFY's results but INTC's earnings out Tues is the unofficial kick-off to the Q1 reports. On the news front today, JPMorgan is publishing earnings previews for US and European semis (for the US semis, C Danley expects the semiconductor stocks to trade up into earnings this week, then we think peak soon after Intel reports. We then expect a sell-off into May). Digitimes is reporting that TSM and UMC are expected to post 10-20% Q/Q rev growth for Q2 due to strong demand and visibility that is stretching into Q3. However, some are increasingly worried about double ordering. Powerchip raised its '10 capex forecast by 18%. Bloomberg is reporting that Palm has retained bankers and is exploring a sale of the company.

• Hedge funds buying equities at fastest pace since ’07; banks have been the biggest target of hedge fund share buying over the past month – London Telegraph

• Insider buying hits new low - Insider buying cratered in the week ending April 9th; total purchases were just $2.1MM; heavy insider selling continued – insiders unloaded $824MM into the market (Business Insider).

• Weekend M&A – MIR and RRI to merge; Bloomberg says PALM has hired bankers and is seeking bids

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=54b8fb4f-84cc-44fa-97f6-67877aafef26)

No comments:

Post a Comment