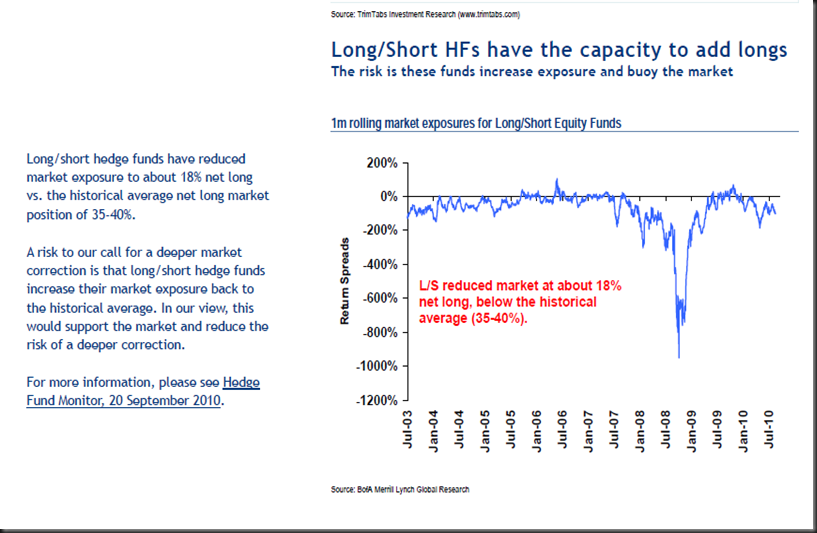

Long/short hedge funds have reduced market exposure to about 18% net long vs. the historical average net long market position of 35-40%. A risk to our call for a deeper market correction is that long/short hedge funds increase their market exposure back to the historical average. In our view, this would support the market and reduce the risk of a deeper correction.

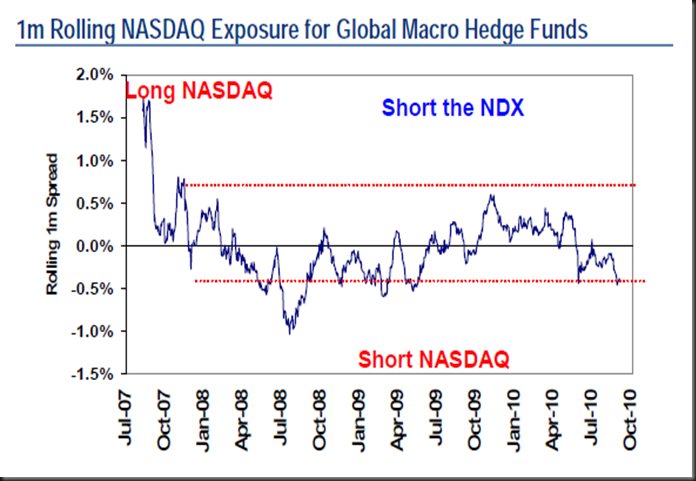

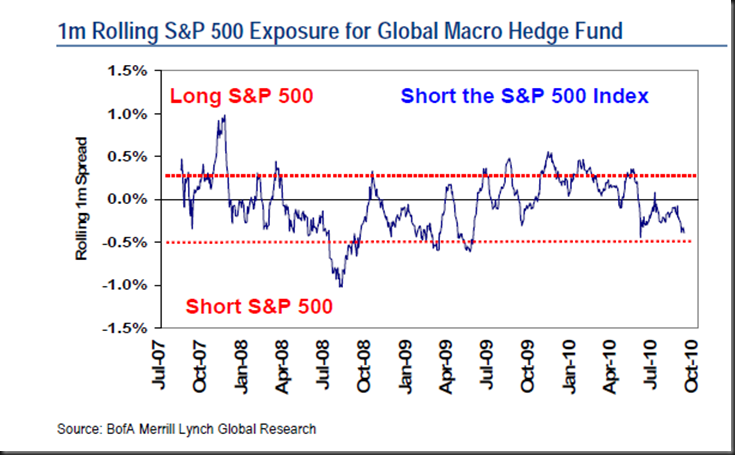

Macros Exposure Analysis Macro hedge funds were down 0.56% last week and are down 1.1% quarter-

todate. Based on our exposure analysis, macros are reducing their US Dollar long position and noticeably covered their commodities short. In equities, macros slighted increased their short positions in S&P 500 and NASDAQ 100 and tilted further to small caps. Macros continued to add to their net short in US 10-year T-notes. Macros do not have any crowded net long or net short positions in these markets.

No comments:

Post a Comment