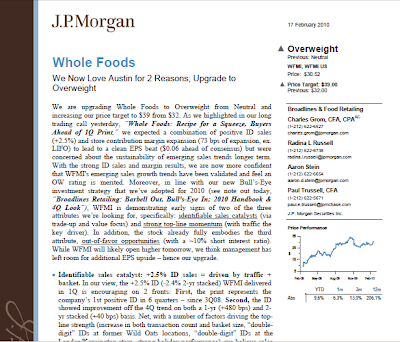

We are upgrading Whole Foods to Overweight from Neutral and

increasing our price target to $39 from $32. As we highlighted in our long

trading call yesterday, “Whole Foods: Recipe for a Squeeze, Buyers

Ahead of 1Q Print,” we expected a combination of positive ID sales

(+2.5%) and store contribution margin expansion (73 bps of expansion, ex.

LIFO) to lead to a clean EPS beat ($0.06 ahead of consensus) but were

concerned about the sustainability of emerging sales trends longer term.

With the strong ID sales and margin results, we are now more confident

that WFMI's emerging sales growth trends have been validated and feel an

OW rating is merited. Moreover, in line with our new Bull’s-Eye

investment strategy that we’ve adopted for 2010 (see note out today,

“Broadlines Retailing: Barbell Out, Bull's-Eye In; 2010 Handbook &

4Q Look”), WFMI is demonstrating early signs of two of the three

attributes we’re looking for, specifically: identifiable sales catalysts (via

trade-up and value focus) and strong top-line momentum (with traffic the

key driver). In addition, the stock already fully embodies the third

attribute, out-of-favor opportunities (with a ~10% short interest ratio).

While WFMI will likely open higher tomorrow, we think management has

left room for additional EPS upside – hence our upgrade.

full report here

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=270c4684-8b8a-4a1d-8852-85d0ad4d9dd7)

No comments:

Post a Comment