Today's Top Stories

Keys for today: NYT says China yuan reval to come within next few days; Greek CDS @ all-time wides; ECB mtng due out this morning (focus on new lending rules); retailer sales hit all morning; LCC/UAUA in merger talks per NYT/WSJ; Kohn/Bernanke speak after bell

European shares were hit as Greek CDS spreads blow out to all-time wides (traded out 32bps to a record 445.5 overnight per CMA DataVision) despite positive comments from Greek officials (i.e. Greek central bank official said that bank deposit outflows have stopped, finance minister said Greece is continuing to borrow normally and is executing its fiscal consolidation plan on schedule, etc.). Also weighing on European shares were cautious comments from the Bank for Int'l Settlements (BIS) which said the UK needs "drastic" austerity measures to prevent public debt from exploding out of control and that the Sovereign debt crisis is at a "boiling point."

European shares were hit as Greek CDS spreads blow out to all-time wides (traded out 32bps to a record 445.5 overnight per CMA DataVision) despite positive comments from Greek officials (i.e. Greek central bank official said that bank deposit outflows have stopped, finance minister said Greece is continuing to borrow normally and is executing its fiscal consolidation plan on schedule, etc.). Also weighing on European shares were cautious comments from the Bank for Int'l Settlements (BIS) which said the UK needs "drastic" austerity measures to prevent public debt from exploding out of control and that the Sovereign debt crisis is at a "boiling point." Greece – update from JPMorgan's D Mackie - the 3.6% decline in Greek bank deposits (of domestic residents excluding the government) over the past two months is very striking. This is the largest two-month decline since February 2002, when deposits fell 3.7%. there is clearly something going on in addition to the normal seasonality. It could reflect corporates paying higher taxes as fiscal tightening bites, residents buying higher yielding government debt, or residents moving money abroad to avoid future tax increases. Alternatively, it could reflect increased concern about bank solvency and the ability of the government to support the banks in a crisis. For now it looks more like the former than the latter.

On the eco front, Eurozone Jan Retail sales came in worse, Spanish IP fell more than expected in Feb. and UK Feb. Manufacturing was stronger than expected. In Asia, shares traded off after weaker Japan Feb. Machine orders (dn 5.4% vs. St. +3.7%).

China property developers - concerns that Shanghai may impose a new property tax (this story weighed on shares of property developers). Also - China's property market is a bubble that may burst by as early as this year, according to hedge fund manager James Chanos (Bloomberg)

China property developers - concerns that Shanghai may impose a new property tax (this story weighed on shares of property developers). Also - China's property market is a bubble that may burst by as early as this year, according to hedge fund manager James Chanos (Bloomberg) China and the yuan - the NYT says that China is close to unveiling as revision to its yuan valuation, w/an announcement potentially coming within the next few days; according to the NYT, the adjustment "will allow greater variation in the value of its currency combined with a small but immediate jump in its value against the dollar"; The model for the upcoming shift in currency policy is China's move in 2005, when the leadership allowed the renminbi to jump 2 percent overnight against the dollar and then trade in a wider daily range, but with a trend toward further strengthening against the dollar. (NYT

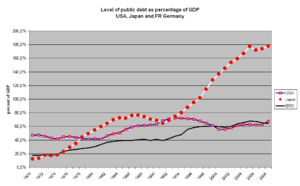

Sovereign debt crisis at a "boiling point" according to the BIS; "Sovereign debt is already starting to cross the danger threshold in the United States, Japan, Britain, and most of Western Europe, threatening to set off a bond crisis at the heart of the global economy" (London Telegraph).

Consumer – bunch of headlines - FDO started things off Wed morning w/strong earnings and the stock traded well on Wed. After the close yesterday, BBBY results beat expectations. The focus Thurs morning will be same-store-sales from US retailers (COST is the first out of the gate w/#s – sales were pretty much inline although may not be enough; ANF looks disappointing….keep in mind expectations are pretty heightened for US retailers today). The rally in retail is starting to look a bit rich according to the WSJ; "there is a good chance retail shares may be ready to plateau"

LCC and UAUA are back in merger talks according to the WSJ; the talks have recently "heated up" although aren't that far along and could falter again. WSJ

Credit - some hedge-fund managers are pulling back from fixed-income bets or looking for protection in case the rally turns into a rout, investors said this week – Marketwatch.

Carlsberg staff strike for second day over ban on drinking at work; the co on April 1 made a decision to introduce new rules for employees on beer drinking at work (Reuters).

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=f5bc427d-d2c3-4285-9b83-9b3d8f55457c)

No comments:

Post a Comment